The words of the month for April was recovery and supply. In the City of Toronto, we're seeing numbers coming closer and closer to last year's all time highs due to a lack of supply in many areas of the city. But we're not quite there yet, and appear to be only entering our recovery phase from last year's correction.

Our President and CEO Chris Kapches breaks it down below; check out the video or read along. Be sure however to check out the chart of the average sale prices for the GTA from the past year, so you can get a sense of where we've been over the last year and where we appear to be headed.

TORONTO REGION

REAL ESTATE MARKET REPORT

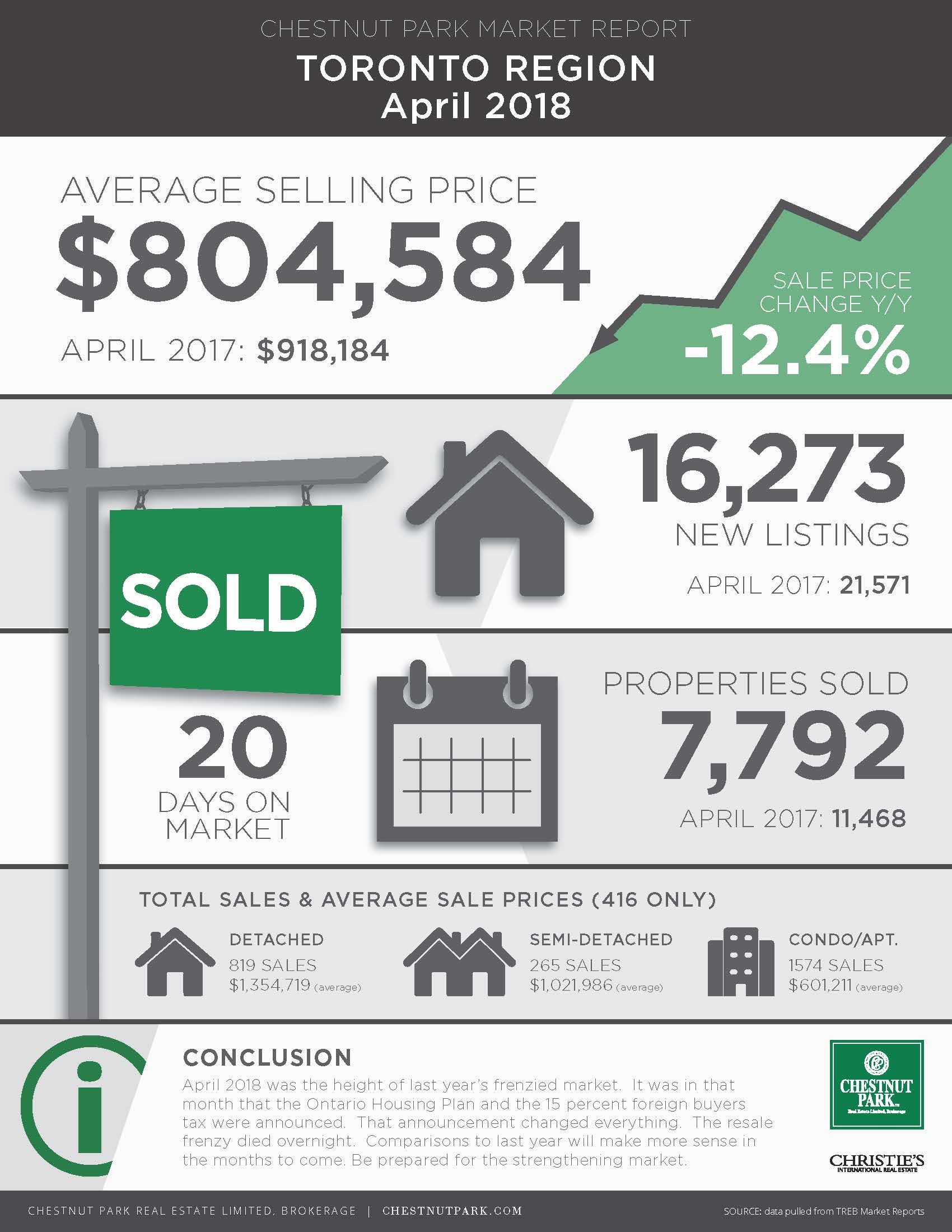

The Toronto and area residential resale market continued its recovery in April. For the fourth consecutive month, the market has shown improvement in both the growth of average sale prices and the number of properties reported sold. In April 7,792 residential properties were reported sold, and the average sale price for all properties reported sold in the Greater Toronto Area came in at $804,584. In January, the average sale price had slumped to $735,754. In four months, Toronto’s average sale price has increased by almost 10 percent.

The market has not recovered to where it was in April 2017, but it is showing signs that it might, particularly in the City of Toronto (416 region). The reason for this recovery is obvious. The fundamentals that drove the frenzied early 2017 resale market are unchanged: strong employment numbers, a growing economy, migration to the greater Toronto area, and insufficient inventory to meet buyer demand. With more than 100,000 people migrating to the Toronto area annually, the supply-demand scenario is no longer in balance. It’s a testament to the strength of the Toronto resale market that it has continued to recover notwithstanding three mortgage interest rate hikes and new more rigid stress testing for mortgage qualification.

In the City of Toronto, the average sale price came in at $865,817 for all types of properties sold, including condominium apartments. The cost of a detached property rose to $1,354,719, while semi-detached homes came in at $1,021,986. These numbers are starting to approach the numbers that the market was producing last year. Year-over-year sale volumes are down by 34 and 16 percent respectively, but in the case of semi-detached properties, this is a product of supply and not demand. In some of Toronto’s trading area, there were no reported sales of semi-detached properties. That’s because there were no listed properties for buyers to buy.

The strength of the market is profoundly demonstrated by the short time periods that detached and semi-detached properties remained on the market. All detached properties sold in only 17 days and for an amazing 101 percent of their asking price. All semi-detached properties sold in an eye-popping 13 days and for a startling 106 percent of their asking price. These numbers are only slightly short of what was happening last year.

Condominium apartment prices have risen consistently, even through the downturn in the market following the announcement of the Ontario Fair Housing Plan in April of last year. In April, and for the first time, the average sale price for all condominium apartments sold exceeded $600,000 coming in at $601,211. In Toronto’s central core, where more than 67 percent of all sales take place, the average sale price reached $667,345. Toronto’s most affordable housing form is rapidly becoming less affordable. Not only did condominium apartments sell with growing average sale prices, but they all sold in only 16 days and at 101 percent of their asking price. In the central core, they also sold at 101 percent of their asking price and in only 15 days.

Condominium Apartment sale prices are, like other housing forms, being driven by a severe lack of supply. At the end of April, there were only 2,130 apartments available to buyers, a little more than one month’s supply. Last year at the height of Toronto’s frenzied market there were 2509 condominium apartments on the market, a year-over-year decline of available inventory of more than 15 percent.

The high-end market has been the only laggard in Toronto’s resale market. Year-to-date only 600 properties having a sale price of $2 Million or more have been reported sold. Last year 2221 had been reported sold, a decline of more than 73 percent. This market sector is, however, also improving. In April the negative variance, as compared to last April, was only 48 percent.

The Toronto and area marketplace is beginning to send out two powerful messages. Firstly, the foreign buyer’s tax that was part of the Ontario Fair Housing Plan was directed towards a non-existent enemy. There were no hordes of foreign buyers buying Toronto real estate. There were no barbarians at the gate. That has been subsequently verified by not only the provincial government but by other sources, namely the Toronto Real Estate Board and CMHC. Secondly, the Toronto resale market is being driven by local, domestic forces. That being the case, governments should abandon any attempt to engineer the marketplace and focus on measures that will help the increase of supply.

Prepared by: Chris Kapches, LLB, President and CEO, Broker