Each week The Glenn Team provide highlights from the weekly CP office meeting to provide a balanced overview of the Toronto and GTA markets and relevant issues affecting real estate markets. Meetings are overseen by Chestnut Park's CEO and Broker of Record, Chris Kapches, LLB, who provides weekly analysis and commentary. Additional input is provided by the CP Toronto office Realtors who give a day to day, real life perspective of the local markets.

TORONTO MARKET SUMMARY

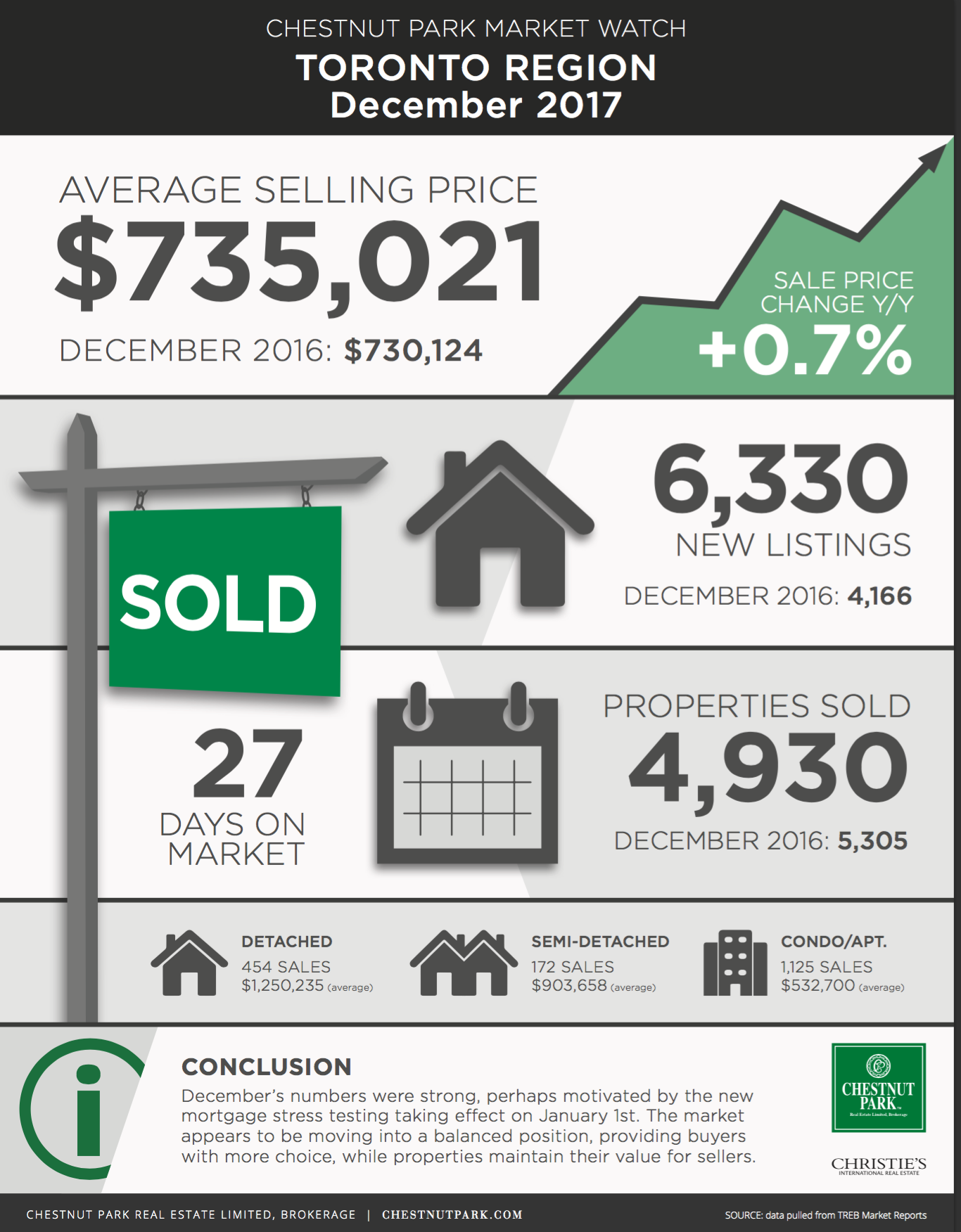

As TREB continues it's freeze on weekly stats, Chris has continued to collect his own in the 416 area code. More deals were done last week than in the first two weeks, though not many more. Inventory levels remain low and are looking to be about 20 - 25% lower than last year. As of the January 18th, there were 771 properties reported sold putting us on pace for around 1,500 sales for the month, compared to the 1,900+ from January 2017. The average sale price in the 416 is about $710,000, a decline of about 1.5 - 2.5% from last January. This is actually pretty good considering the highs the market came from in January 2017. Where the market continues to fall short is in inventory, which will almost certainly affect sale prices going forward. This continues to be the case with condo apartments whose average sale price came in at $556,156 for the 155 sales across the 416 area; 93 of which sold in the Central districts.

Other parts of the country are up and down. Vancouver continues to outperform any other city nationally, with their average sale price going up 16% year over year to $1,060,000. Regina and Calgary have had harder times with their average sale prices coming down by 4% and .4% respectively. Ottawa's average sale price is up by 6% year over year, which could be an indication that foreign capital is looking to our capital to invest in other markets; though this is simply speculative. Oakville and Milton prices are down by about 4.8%, which is comparable to other GTA markets. All of this makes for a confusing and fractured marketplace nationally, especially in light of the next agenda item.

INTERESTED?

Our resident mortgage expert, Darlene Hanley came into the office to discuss how the new stress test and BoC interest rates are affecting those looking at purchase, pre-approvals and refinancing.

Here's a summary of what she said. We've also included a link to her presentation here, which contains more examples of the info. below.

NEW RULE CHANGES

On January 1st, 2018, OSFI implemented new conventional (uninsured) mortgage rules, attempting to protect homebuyers from mortgage default in a rising interest rate environment.

The government introduced a rate cushion which will affect all uninsured mortgages (those with a down payment of 20% and all refinances). They must now qualify at the greater of:

The Bank of Canada posted rate (4.99%)

OR

Their contract rate + 2%

This means, if your rate is 3.39%, you would be qualifying at 5.39%

Some Other Important Notes

- If a legally binding Purchase and Sale Agreement is dated/signed prior to January 1, 2018, the customer can qualify under the old rules.

- If the legally binding Purchase and Sale Agreement is dated/signed on or after January 1, 2018, the customer must qualify under the new rules.

BANK OF CANADA RATE INCREASE

On January 17th, 2018, the Bank of Canada increased its overnight lending rate to 1.25% from 1%. The major 6 banks have followed their lead, and increased their prime rate. Each lender decides what their prime rate will be.

EX: Scotiabank’s Prime Rate is now 3.45%, RBC as well, up from 3.20%. TD has a prime rate of 3.60%, up from 3.45%.

Changes in Prime influence variable interest rates, ie. if you have a variable rate of Prime – 0.50% with Scotiabank:

Before the stress test: 2.70%

After the stress test: 2.95%

= Increase of .25%

INSURED MORTGAGES

Insured mortgages are only available for properties under $1M for purchases with a down payment of less than 20% and are insured by one of the three insurers in Canada. The minimum down payment is 5% on the first $500,000 and 10% on the difference up to $999,999.

EX: If you are purchasing for $800,000, the minimum down payment would be $55,000 ($25,000 on $500,000 and $30,000 on the other $300,000)

Those looking for an insured mortgage will be qualified at the Bank of Canada posted rate of 4.99% or their contract rate, whichever is higher. This means, even if your contract rate is 3.14%, you still have to be able to qualify for a mortgage with a rate of 4.99%.

This may price many first time buyers out of the market, whose only hope of homeownership in Toronto is/was through insured mortgages.

UNEMPLOYMENT = UNRELIABLE

Due to the Real Estate market being so wrapped up in the economy, and economies tied to indicators such as the unemployment rate and the GDP, Chris thought this new study by The Fraser Institute was instructive as far as how we should view unemployment, or rather employment, as a means to determining economic strength.

Essentially, the study looks at how unemployment rates have traditionally been used to indicate strength in labour markets but that "the unemployment rate can decrease for two reasons that imply very different performance: 1) people are finding work, which is positive; or 2) potential workers are dropping out of the labour force and not looking for work anymore, which is usually negative."

Additionally, since 2008, the labour force participation rate has declined 67.6% - 65.7% and is expected to decline further due to Canada’s increased ageing population. So the institute is recommending going forward that we should be using the employment rate as the best barometer for the state of the labour market. Click the link above to read more.

WHAT DO YOU THINK?

Are you enjoying our weekly posts? Looking to get something else out of them? Is there a way we can improve? We'd love to hear from you. Please leave a comment below or get in touch directly!