Each week, The Glenn Team provide highlights from the weekly CP office meeting to provide a balanced overview of the Toronto and GTA markets and relevant issues affecting real estate markets. Meetings are overseen by Chestnut Park's CEO and Broker of Record, Chris Kapches, LLB, who provides weekly analysis and commentary. Additional input is provided by the CP Toronto office Realtors who give a day to day, real life perspective of the local markets.

First off, our apologies for not putting up a post last week but we've got lots of good stuff to share this week, among them many an acronym and pun-filled headings...

MARKET UPDATE

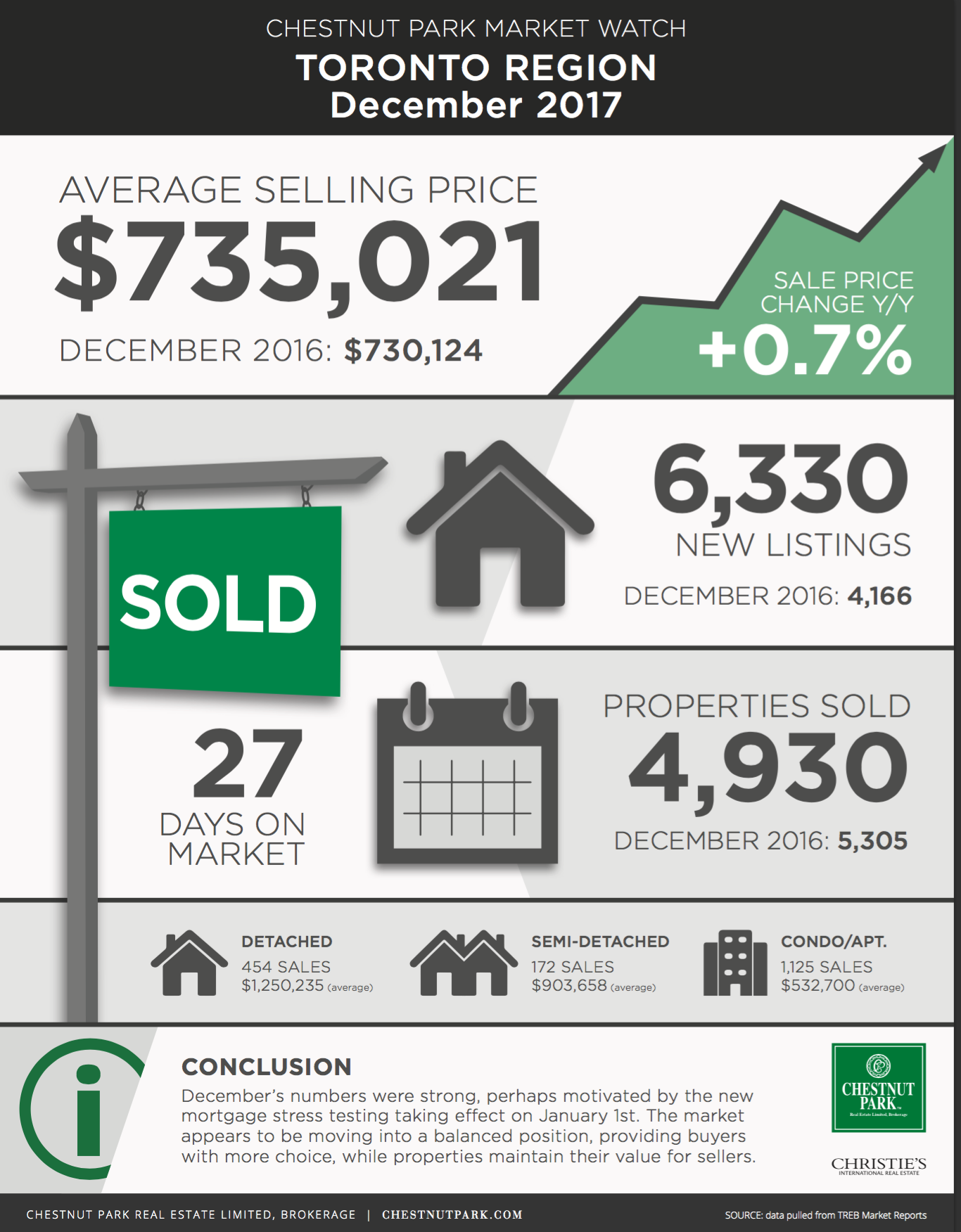

Chris continues to collect his own stats for the 416 area code, or the City of Toronto proper. We continue to see a rise in the average sale price up to $785,000 for the 416. Inventory remaining low is likely the best indicator for this continuation of an upward trend. All reports from CP agents working in the 905 indicate that things there are worse there however, and in some areas stagnant. TREB's stats, which came out today, indicate a decrease in average sale price across the GTA of about 2% since last November; not surprising given the number of detached properties that sold then as opposed to this November. However, as we've noted in previous posts, this negative variance is one which is shrinking by the month. January's numbers will likely increase this year over year negative variance given prices from the beginning of 2017 but again, it's important to recognize how unsustainable that market was.

TREB board president Tim Syrianos seems to now be echoing what we've been reporting on for months now...

"We have seen an uptick in demand for ownership housing in the GTA this fall, over and above the regular seasonal trend. Similar to the Greater Vancouver experience, the impact of the Ontario Fair Housing Plan and particularly the foreign buyer tax may be starting to wane. On top of this, it is also possible that the upcoming changes to mortgage lending guidelines, which come into effect in January, have prompted some households to speed up their home buying decision."

Lastly, condominiums have continued to make the biggest strides in prices, averaging 16.4% across the GTA. So long as inventory continues to be low, we can expect prices to continue to rise going into 2018.

UNEMPLOYMENT ENJOYMENT

Canada's unemployment stats came out last Friday and are staggeringly low at about 5.9%; the best numbers seen since February 2008. Over the past 12 months, Canada gained 390,000 full-time jobs, with men in the 25 to 54 core-aged group, youths aged 15 to 24 and women aged 55 and older receiving the lion's share of the jobs. Not surprisingly, Ontario led the provinces with 44,000 new jobs created in November, mostly in the wholesale and retail trades in addition to the manufacturing sector. Ontario’s unemployment rate is now at 5.5%, which is the lowest it’s been since 2000.

Will this help or hinder the real estate industry? Chris indicated that these numbers could mean a further interest rate hike by the Bank of Canada; something that was already posited in past meetings and many in the mortgage world feel is almost certain in 2018. Last Friday, after the rates were published, the Canadian dollar jump up a cent against the U.S. dollar. Given this information, along with the proposed wage increases scheduled for next year, many economists feel that we're looking at further rate hikes in January. “It certainly firms the idea that there are more near-term hikes than previously anticipated,” said Michael Dolega, senior economist at Toronto-Dominion Bank.

R.R.S.P. FOR THE WHOLE FAMILY

The Canadian Real Estate Association is asking the federal government to extends it's policy allowing RRSP contributions to be used as a tax-free downpayment to parents wanting to help their children make a purchase in real estate. Additionally, the association wants the limit for withdrawal to be bumped up to $35,000 from the $25,000 that is currently allowed. Most in the CP office felt this limit could be raised even further given the average selling price across Canada now being up to $550,000. Though that average price is likely more reflective of the high values being seen in Toronto and Vancover, even a $35,000 deposit is only negligible for the purposes of making a down payment.

Chris did bring up the fact that many first time home buyers may not have even that much in their RRSPs but that certainly allowing parents to add some of their own RRSP funds to the mix should help, given there is good evidence to show an existing "shadow economy" already at play in the real estate market; ie. parent's giving money to their kids for down-payments.

Thomas Davidoff, a professor at UBC's Saunder School of Business said there is no clear answer as whether this policy is good or bad. Davidoff feels this policy could undercut people's retirement savings, would push up housing prices further, and would enable only wealthier families to have greater buying power. Davidoff feels that the government would better serve the market by introducing more taxation on home owners.

Darlene Hanley - our resident mortgage expert - said that she's seen this shadow economy in action already. With some families contributing upwards of $200,000 in down payment gifts for their children. While that scenario is likely rare, I feel like it underscores the reality of what wealthier families are already able to do. This policy might better serve families who don't have as much. Whether it hurts their retirement savings is something each family would have to judge for itself.

We would love to know your thoughts on this matter. Leave a comment or get in touch directly!

LTT TO SAVE T.O.'s B

Last Thursday, the City of Toronto announced their new annual budget and among the expected revenues, the municipal Land Transfer Tax is expected to make up almost 10% of the city's earnings for 2018. In total, city manager Peter Wallace is conservatively estimating about $800M to come from the LTT despite what many call a slow down in the housing market. If you've been keeping track with our weekly posts however, I think Mr. Wallace is likely correct. We've been experiencing steady price growth and it seems the same with be true in 2018. It is astonishing however to consider how much home buyers contribute to the infrastructure of this city. There have been more than enough articles being critical or down right angry about the upward trend in housing prices but in realizing how much of that money goes to essential services in the city, you'd expect any commuter or tourist to sing the praises of the Toronto home buyer.

For more information on how LTT has and will have an effect on the proposed budget, check out this article in the Globe and Mail

YOU SAY PROPRIETY, TREB SAYS PRIVACY

No matter how you want to argue it, the Federal Court of Appeal ruled against the Toronto Real Estate Board in deciding to uphold an April 2016 Competition Tribunal ruling that TREB's practices prohibiting sharing information online are anti-competitive. The general sentiment in the CP office was that TREB should have made this an argument about propriety; namely that for years, members of TREB have paid dues to develop a system whereby Realtors are better able to serve their clients through the use of sales data and other companies that have similar data (VISA for instance), would never be made to share that data. TREB however, didn't make an argument based on propriety but instead on consumer privacy. TREB CEO John DiMichele said that

TREB believes strongly that personal financial information of homebuyers and sellers must continue to be safely used and disclosed

The tribunal found that TREB's actions had been in line with anti-competitive practices and hopes that this ruling will open up competition in the digital space to companies like Realosophy or Zillow; based in Seattle. Proponents of the anti-competition viewpoint feel that this data would allow buyers to make a better informed decision prior to seeking the use of a Realtor and would allow realtors and brokerages the ability to publish better sales information; ie. which neighbourhoods are appreciating the fastest.

In the U.S., where this data has been available for sometime, the real estate market continues to thrive but we're sure there will be more than a few realtors who aren't happy about the decision. TREB is appealing the ruling in the Supreme Court.

Chris' sentiments on the matter were that competition bureau outcomes have had effects on the real estate industry in the past and we still have a thriving marketplace. What he did find offensive is that the media seems to be painting Realtors as being dishonest in how we are using this information; that we would use it to our benefit in obtaining a higher sale price, regardless of the data. We would echo Chris' sentiments and also argue that sellers are just as interested in getting the highest price for their property. That being said, any realtor who uses deceptive practices to build their business will fail at some point. Perhaps we are more honest than most?

Again, we would value your feedback on any of the topics mentioned. We try to offer our clients and reader base, the most informed and accurate opinions of the market and of the real estate world in general. Please leave a comment below or get in touch directly.